Reinventing Mobile Banking - A Fresh Look

The way we handle our money has, in a way, really changed over time, moving from physical visits to a place with tellers to screens in our pockets. This shift is more than just a simple move; it's about making something that already exists feel brand new, almost as if it were made for the very first time. We are seeing a real push to make these digital money tools work better for everyone, to change parts that might not be working so well or aren't helping us anymore. It’s about taking what we know about managing money on our phones and giving it a fresh coat of paint, a new purpose even.

You know, for a long time, the idea of banking meant going to a building, standing in line, and talking to someone face-to-face. Now, we pull out a small device, and with a few taps, we can pretty much do anything we need with our cash. This big change, though, still has room to grow, to get better, to feel more like it truly fits into our daily routines. It's about looking at what's there and figuring out how to make it more useful, more friendly, and perhaps a bit more thoughtful for us, the people using it every single day. We're thinking about how to transform what we have into something that serves us better, something that really understands what we need. So, this conversation is about looking at what "reinventing" means for the way we handle money on our phones.

The core idea of making something new from something old, or changing parts that aren't quite right, can really apply to so many things, can't it? Just like a family eatery might adjust its menu to focus on what it does best, or a cook might alter a classic recipe to fit a different kitchen, mobile money services can also be reshaped. It's about bringing back into use parts that were good, and replacing other bits with something completely different, a fresh take on what's already there. This means we get to look at how we manage our funds and think about how we can truly make it work for us in a very personal way. It's about adapting and shaping these tools to be more helpful, more intuitive, and just generally more pleasant to use, too it's almost.

Table of Contents

- What Does Reinventing Mobile Banking Truly Mean?

- Making Mobile Banking More Personal

- How Can We Make Mobile Banking Feel More Like Us?

- The Core Idea of Reinventing Mobile Banking

- What Are the Everyday Benefits of Reinventing Mobile Banking?

- Simple Changes for Reinventing Mobile Banking

- Where Do We Go Next with Reinventing Mobile Banking?

- Looking Ahead for Reinventing Mobile Banking

What Does Reinventing Mobile Banking Truly Mean?

When we talk about making mobile money services new again, we are really talking about taking something that already exists and making it feel as if it were created for the very first time. It is not about throwing everything out and starting from scratch, not at all. Instead, it is about looking at what is currently there, what works and what doesn't, and then making thoughtful changes. This might mean redesigning how things look on the screen, or changing how we go about paying bills or sending cash to friends. The goal is to produce something fresh, something that feels more helpful and less like a chore. It's about transforming the experience, making it more intuitive and perhaps even a bit more enjoyable for people to manage their money on the go. So, it's about modifying and altering what's present to bring back into use what's good and make new what needs to be new, you know.

Making Mobile Banking More Personal

A big part of reinventing mobile banking involves making it feel more like it's just for you. Think about it, when you go to a place to eat, sometimes the best ones are those that feel like they know what you want, almost before you ask. Similarly, mobile money tools could learn from how you use them and offer things that really matter to you. This could mean showing you your most common transactions first, or giving you quick ways to pay your regular bills. It’s about shaping the service to fit your habits, rather than making you adapt to its ways. This kind of personal touch can make a huge difference in how comfortable and easy it feels to handle your funds every day. It's about adapting the tool to your life, rather than the other way around, basically.

How Can We Make Mobile Banking Feel More Like Us?

To make mobile money services feel more like they are truly ours, we need to think about how people actually use them in their daily routines. It's not just about adding new features; it's about changing parts of the current system that might not be serving us well anymore. For instance, if checking your balance takes too many steps, or if sending money feels confusing, those are the areas that need a fresh look. We could simplify the steps, use clearer language, or even allow for more ways to interact, perhaps through voice commands or quicker access points. It’s about taking what's there and making it more intuitive, more seamless, so that it just flows with how we live. We want to reclaim the idea of easy money management, making it something that truly fits our individual pace, so.

The Core Idea of Reinventing Mobile Banking

The heart of reinventing mobile banking is about taking something that already exists and giving it a new life, a new purpose, or a new way of working. It's like when someone takes an old idea, perhaps a classic dish, and prepares it in a totally new way to fit modern tastes. This involves transforming the existing structure, redesigning how it operates, and modifying its appearance to be more inviting and useful. We are looking to make these services feel as if they were thought up just for today's needs, even though they have been around for a bit. It’s about remaking the experience, altering how we interact with our money, and shaping it into something that feels truly current and helpful, in a way.

What Are the Everyday Benefits of Reinventing Mobile Banking?

When mobile money services are truly made new, the benefits for everyday people can be quite noticeable. Imagine being able to pay a bill with just one tap, or quickly seeing all your spending habits laid out in a way that makes sense to you. These small changes add up to a much smoother day-to-day experience. It means less time spent figuring things out and more time for what truly matters to you. It could also mean getting helpful nudges about your spending, or alerts that prevent you from making mistakes with your cash. The idea is to make managing your funds less of a chore and more of a simple, almost thoughtless part of your day, freeing up your mental space. It's about making financial tasks feel less heavy and more like a gentle breeze, you know.

Simple Changes for Reinventing Mobile Banking

Sometimes, the biggest improvements come from the smallest adjustments. For reinventing mobile banking, this could mean making the buttons bigger and easier to press, or using clearer words instead of confusing bank talk. It might involve letting you customize your home screen so your most used features are right there when you open the app. Think about how a simple sign outside a restaurant can tell you if they have seating service or not; clarity helps so much. These simple modifications can make a world of difference in how easy and pleasant it is to use the service. It's about altering the small details to improve the whole picture, making it more welcoming and straightforward for everyone. So, these kinds of redesigns can really make a difference, as a matter of fact.

Where Do We Go Next with Reinventing Mobile Banking?

Looking ahead, the path for making mobile money services new again involves thinking about how our lives are changing and how these tools can keep up. Just like restaurants sometimes specialize in smaller menus because that's what they do best, perhaps mobile banking could focus on being exceptionally good at a few core things, or allow users to pick and choose what they see. We are thinking about how to keep transforming these services so they always feel current and helpful, not stuck in the past. It means continually redesigning and adapting, always with the user in mind. The goal is to make sure these tools remain relevant and genuinely useful as our lives continue to shift and grow, so.

Looking Ahead for Reinventing Mobile Banking

The future of reinventing mobile banking holds the promise of tools that are even more integrated into our lives, yet remain very simple to use. We might see more features that help us plan for the future, or even offer gentle guidance on our money choices, all within the same easy-to-use app. It’s about remaking the experience so it feels less like a strict financial tool and more like a helpful friend. This means constantly bringing back into existence ideas that were good, and replacing older methods with fresh, intuitive ones. The ongoing effort to shape and adapt these services will ensure they keep pace with how we live and what we need from our money tools, pretty much.

This article has explored the idea of making mobile banking new again, drawing on the concept of taking something already invented and making it feel as if for the first time. We've talked about changing parts that no longer serve us, transforming existing structures, and redesigning how we interact with our money on our phones. We looked at making these services more personal, simplifying everyday tasks, and considering where these changes might lead us next. The focus has been on making mobile money management more approachable, more intuitive, and genuinely more helpful for everyone who uses it.

Reinventing Mobile Banking for a Digital, Global Community

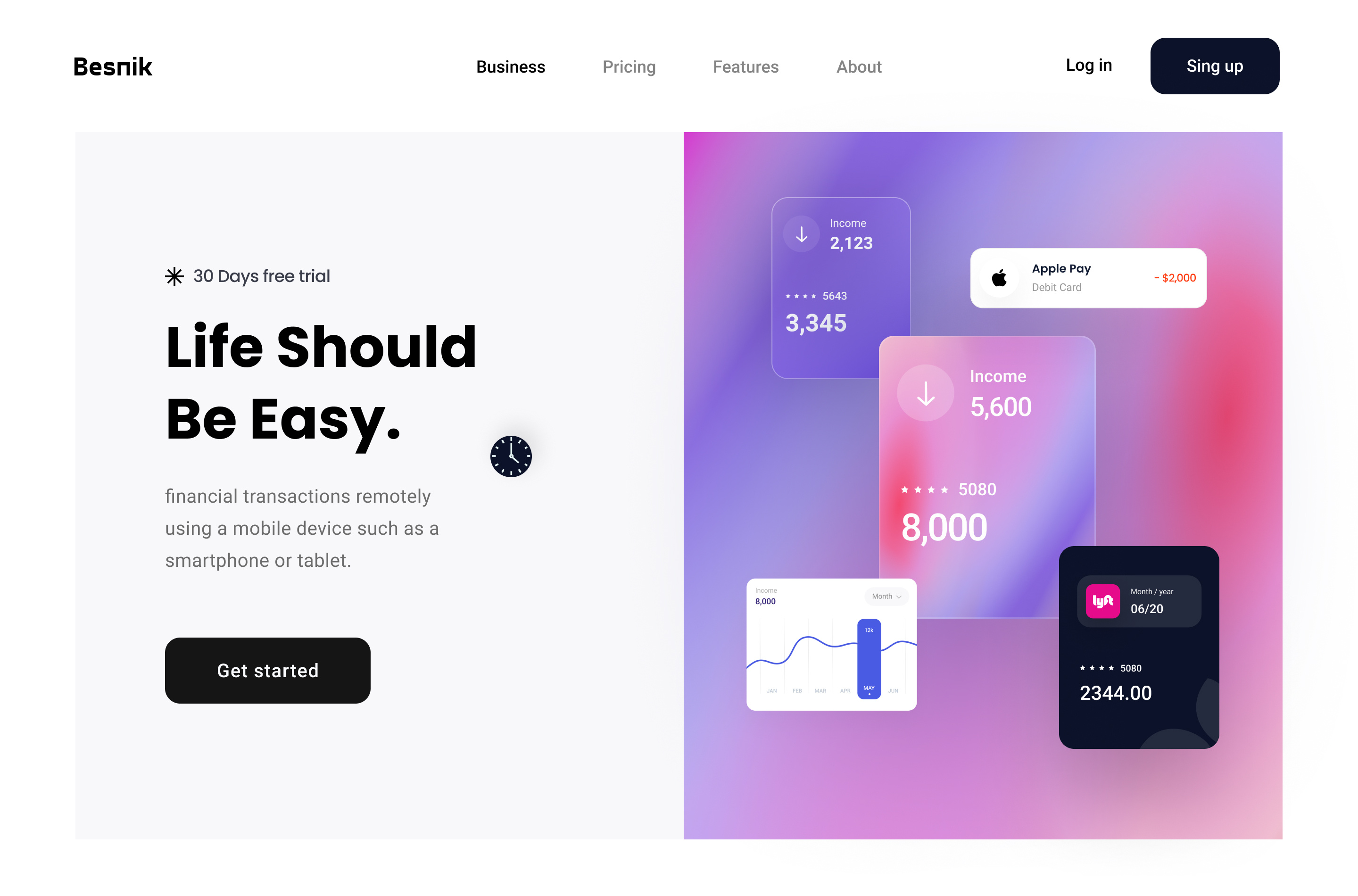

Dribbble - Mobile-Banking Landing Page Full View.jpg by Mansurul Haque

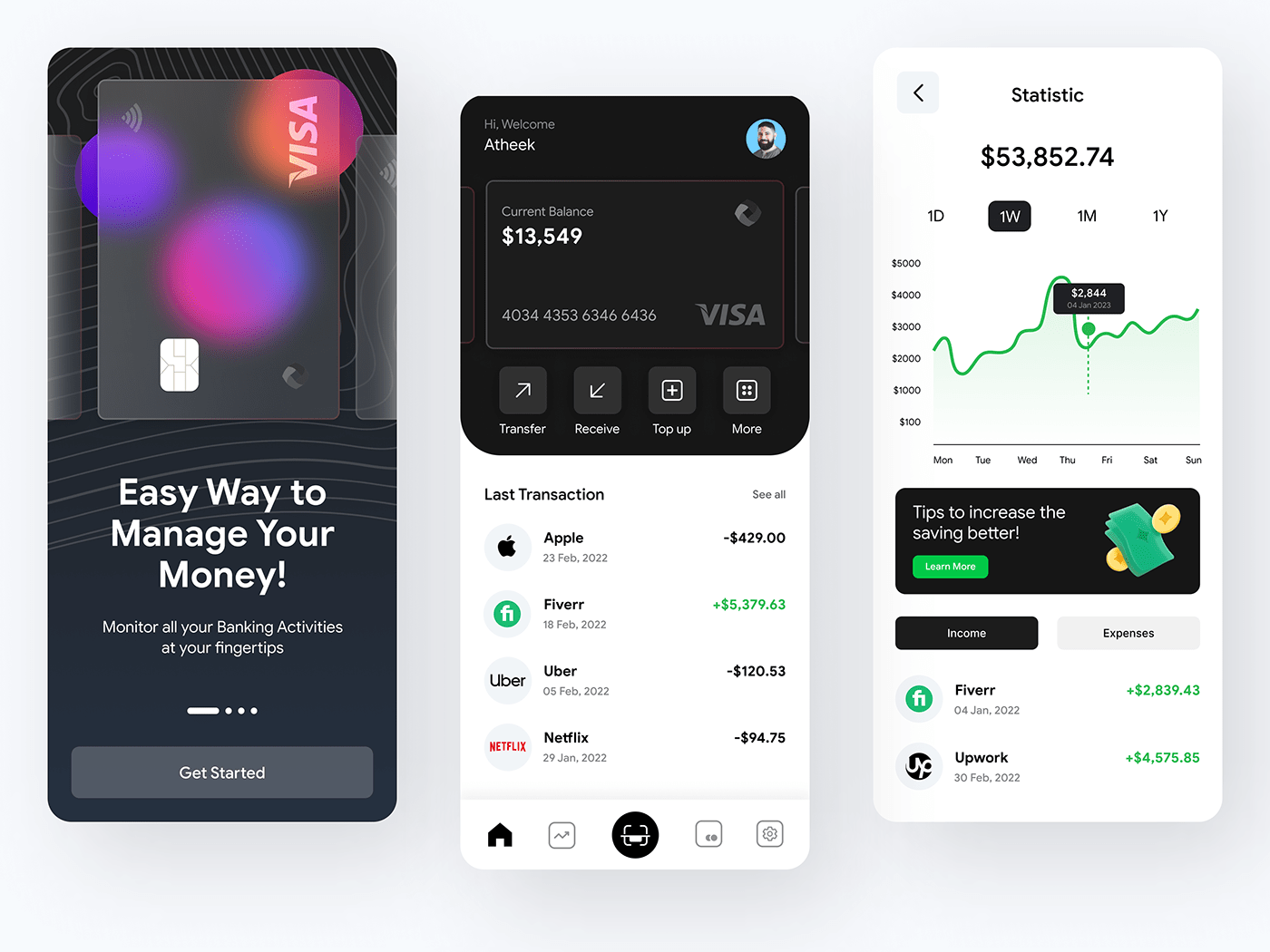

Mobile Banking App on Behance