Unraveling The Knowen - Clarity In Digital Life

It's a feeling many of us have come to experience, that slight pause of confusion when something on our screen just doesn't quite add up. We expect things to work, to be clear, to show us what we need to know right away. When it comes to managing our money or figuring out how to get from one spot to another, what's available to us should, in a way, just make sense.

Yet, there are moments, you know, when the digital tools we rely on for these very important tasks seem to have a mind of their own. Your balance might look a bit off, or a recent purchase isn't showing up where you'd expect it. Perhaps the directions to that new place are taking you in circles, or the map just won't pinpoint where you actually are. These little snags, they can truly throw a wrench into your day.

This discussion, so, is all about those common points of digital friction. We'll look at the sorts of puzzles that pop up when we're trying to keep track of our finances or move through the world with a little digital help. It's about what we've come to expect, what sometimes goes awry, and what we might already have come to have a good sense of when these things happen. It's about making what's "knowen" truly helpful.

Table of Contents

- What's the Real Scoop on Money Movement?

- Keeping Tabs on Your Funds - Is It Always Clear?

- Getting Where You Need to Go - What's the Best Way?

- Why Do Digital Tools Sometimes Act Up?

What's the Real Scoop on Money Movement?

When you send money, say, to pay a couple of bills, you expect that transaction to show up pretty much right away, don't you? It's a rather common expectation. Many of us make at least two payments, maybe fifty dollars or more for each, through our bank's online system or their phone application. This simple action, the sending of funds, is supposed to be straightforward, a thing you can rely on to work without a hitch. People usually count on seeing those debits happen almost instantly, to be honest. It's how we keep track of what's going out and what's left.

Yet, there are times, apparently, when things don't quite go as planned. People have shared stories, you know, about experiencing difficulties with their bank's digital platform. These aren't just minor annoyances; they can be actual problems that make you scratch your head. Sometimes, items you've paid for, or changes you've made to your accounts, just don't seem to appear. They don't show up, they don't change, or they simply don't work as they should. It's a bit like sending a letter and not knowing if it ever arrived, which, for your money, is a rather unsettling feeling.

There's also the situation where you might open a new checking account, expecting it to be linked up with your other accounts in your online view. Or so they tell you. It seems you need at least one checking account to even get things going online. But even then, there are reports of the bank's mobile application being quite a bother to use. It can be a very frustrating experience, people say. This makes you wonder about the overall smoothness of the system, doesn't it? It’s a core part of managing your daily finances, so it really should be seamless.

- Zeal Boutique Pascagoula Ms

- Alicia Smith Wxyz Age

- When Is The Beefy Crunch Burrito Back

- Your Dads Band

- Nike Humara Undefeated

The Knowen Truth About Online Banking Glitches

One of the most talked-about issues, actually, involves purchases. You buy something, and you expect that amount to come out of your available funds fairly quickly. However, sometimes these purchases don't show up until several days after you've made them. This delay can cause a good deal of confusion, especially when you're trying to figure out just how much money you really have available. It's a bit like trying to play a game where the score updates only after a long pause. You can't quite get a handle on your current standing, which is a pretty basic need when it comes to your own cash.

This problem isn't just with checking accounts either. People have mentioned problems with their credit card accounts too, particularly when trying to view them online. It's like a common thread, this inability to access certain details or to see things update as they should. Some folks have even been completely unable to get into specific credit card accounts, like their "we mc" account, which is a pretty big deal when you need to check a balance or make a payment. It really makes you question the reliability of the system, doesn't it?

Comparisons often come up, too. Someone might get their accounts set up with one bank and then find its online site to be, well, quite poor when compared to another bank they've used, like RBC or Tangerine. These other banks, people say, seem to offer a much smoother online experience. This suggests that the way these digital services are put together can vary quite a bit. It’s almost as if some systems are just more intuitive, more direct, and more responsive than others. A primary checking account, for example, really ought to be the central point of your online banking, easily accessible and always up to date.

There have even been times, apparently, when entire systems have gone down. There was an outage, you know, affecting multiple backend systems and online banking for a few hours on a certain day. This kind of widespread problem really highlights how much we depend on these services and how disruptive it can be when they aren't working. It also brings up questions about registration for online banking. One person mentioned that this particular aspect, the sign-up process, really got them thinking about how things are handled. It's a foundational step, after all, to getting things going.

And then there are the more serious matters, like when someone loses a large sum of money to fraudsters. A bank, for instance, might not reimburse a person who lost a lot of money, like twenty-three thousand dollars, to people who tricked them. This story, which was shared on CBC News, really brings home the importance of knowing what protections are in place and what responsibilities fall on the individual versus the institution. It's a rather stark reminder that even with digital conveniences, the real-world consequences of things going wrong can be very significant indeed.

Keeping Tabs on Your Funds - Is It Always Clear?

The whole point of online banking, basically, is to give you a clear, immediate picture of your money. You want to see what's there, what's gone out, and what's coming in. This ability to keep a close watch on your funds is pretty much what makes these digital tools so useful. When you sign into your online banking, you expect to see everything laid out for you, in a way that makes sense. It should be a simple, straightforward view of your financial situation, allowing you to make decisions with confidence. That's the ideal, anyway, right?

However, as we've touched on, this isn't always the case. The confusion that comes from purchases not showing up for days, or from balances that seem to be a bit behind, can create a real headache. It’s like trying to drive with a foggy windshield; you can see something, but it’s not sharp enough to be truly useful. This lack of immediate, clear information can lead to overspending or simply a lot of stress about where your money stands. It’s a pretty common frustration, apparently, for many people who rely on these systems every single day.

The expectation is that your online banking acts as a perfect mirror of your actual money. When that mirror is cracked or slow to reflect, it changes how you manage your daily life. You might find yourself checking your account more often, just to be sure, or even avoiding using your card because you're not quite certain of your real balance. This constant checking, you know, takes up mental space and time that could be used for other things. It’s about the peace of mind that comes from having a clear picture, and when that picture is blurry, it’s a bother.

What's Knowen When Balances Seem Off?

When your money figures just don't seem to add up, it's a common experience that can leave you feeling quite unsettled. The feeling of not truly knowing how much money is in your account can be a bit like walking a tightrope without a safety net. You're trying to be careful, but the ground beneath you feels a little unstable. This situation, where your actual purchases aren't reflected in your online balance for several days, means you're operating with incomplete information, which is something nobody really wants when it comes to their finances.

What's often come to be known in these situations is that patience is required, though it’s not always easy to have. It's also become somewhat common knowledge that these delays can happen, and they're not always a sign of something truly wrong, just a lag in the system. Yet, this doesn't make the experience any less frustrating. People often share stories about having to guess or estimate their true balance, which is hardly ideal for managing a household budget or planning for bigger expenses. It’s a pretty basic need, to know what you have, and when that’s not clear, it causes problems.

Sometimes, too, the issue might be with specific types of accounts, like credit card accounts, which seem to have their own set of quirks when viewed online. The inability to get into your account at all, or to see the correct details, means you're flying blind. This can lead to missed payments, or just a general lack of control over your financial tools. It's almost as if some parts of the system are less polished, less ready for prime time, than others. The expectation is a seamless experience across all your accounts, and when that's not delivered, it's a letdown.

Getting Where You Need to Go - What's the Best Way?

Moving from one place to another, whether it's across town or across the country, often involves relying on digital guides these days. We use services to find driving directions, to look at maps, and to get real-time updates on traffic and road conditions. This ability to get a sense of your surroundings and plan your movement is pretty much a daily necessity for many. It's about having the information you need to make good decisions about your travel, which is a rather important part of getting things done.

These tools also help us find what's around us. We can look for nearby businesses, restaurants, or even hotels, which is incredibly useful when you're in an unfamiliar spot or just looking for something new. The idea is to make your life simpler, to put all that information at your fingertips. And, of course, a big part of using these guides is to avoid getting stuck in traffic. Optimized routes, which help you steer clear of busy areas, are a really helpful feature that many people have come to rely on quite a bit.

The promise of these services is that they can guide you along the way, no matter where life takes you. You can get directions, plan a trip, print out your map, and even get help if you run into a snag. This comprehensive approach to travel planning is meant to give you peace of mind, to make the act of moving from point A to point B as smooth as possible. It’s about feeling prepared and knowing you have a reliable companion for your journeys, which is a pretty comforting thought.

The Knowen Paths for Finding Your Way

When it comes to finding your path, there are certain things that are commonly understood about how these digital mapping services work. For instance, you might want to bring in your route stops from a spreadsheet, which is a rather handy feature for planning a complex trip. The ability to do this, to customize your route with specific points, makes these tools much more powerful for certain tasks. It's about making the tool fit your needs, rather than the other way around, which is a pretty good sign of a useful service.

However, sometimes even with the best tools, you can run into a few technical snags. You might be using a browser that's supposed to be supported, but you're still having trouble with the website. Or, perhaps, your device just can't seem to figure out where you are, like when an Amazon Fire tablet can't find your current location. These little technical hitches can be quite frustrating, especially when you're trying to get somewhere and time is a factor. Knowing how to adjust your settings, or what browser to use, becomes pretty important then.

These services also give you the ability to check flight prices and hotel availability for your visits to different cities. Whether you're heading to Tallahassee, Florida, or Omaha, Nebraska, or even Jacksonville, Florida, or Memphis, Tennessee, you can get directions, maps, and traffic information. This broad coverage, you know, means you can plan trips to many different places with the same tool. It also includes details like road conditions, live traffic updates, and even reviews of local businesses along your path, which is a very helpful addition for travelers.

Why Do Digital Tools Sometimes Act Up?

It's a question many of us have asked: why do these digital tools, which are supposed to make our lives simpler, sometimes just not work right? There's an expectation that technology should be seamless, that it should just operate in the background without us having to think about it too much. Yet, as we've seen with online banking and mapping services, there are moments when they seem to stumble. This can be due to a range of things, from small software quirks to bigger system-wide outages. It's a rather complex dance between the user, the device, and the unseen digital infrastructure.

Sometimes, the issues are about how different parts of a system talk to each other. If one part of the bank's backend system is having trouble, for example, it can affect everything from bill payments to how quickly your purchases show up. It's like a chain reaction, where one weak link can cause problems throughout the whole setup. And then there are the challenges of making sure an application works perfectly on every type of phone or tablet. What works well on one device might be quite a bother on another, which adds another layer of complexity to the mix.

User experience also plays a big role. If a system is not put together in a way that makes sense to people, or if it's difficult to sign up or register, that can cause a lot of frustration. The comparison to other services, like RBC or Tangerine for banking, shows that some systems just feel more intuitive, more user-friendly. This suggests that the way a tool is designed, the thought put into its ease of use, really matters. It's not just about the features it has, but how easy it is to actually use those features without pulling your hair out.

Common Snags and the Knowen Fixes

When digital tools act up, there are some common issues that many people have come to know about. For banking, the delay in seeing transactions appear is a frequently mentioned snag. While there might not be an immediate "fix" for the user, knowing that this delay is a possibility can help manage expectations and reduce confusion about your true balance. It's about being aware that the numbers you see might not be the absolute latest, which is a pretty important piece of information to have.

For navigation tools, problems like a website not working properly even with a supported browser, or a device not finding your current location, are also pretty common. The known solutions often involve checking your device's settings, clearing your browser's data, or making sure your location services are turned on. These are often the first things people try, because they've learned, you know, that these basic troubleshooting steps can often resolve the issue. It's a bit like turning something off and on again; sometimes, that's all it takes.

And then there's the bigger picture of security and fraud. The story of someone losing money to fraudsters, and the bank not reimbursing them, highlights a very serious concern. What's become increasingly known is the importance of vigilance, of being careful about who you share your information with, and of understanding your bank's policies regarding fraud protection. It’s a pretty stark reminder that while digital tools offer convenience, they also come with their own set of risks that people need to be aware of and prepared for.

Ultimately, whether it's managing your money or finding your way, the core of these digital interactions comes down to information. When that information is clear, timely, and accessible, these tools are incredibly helpful. When it's not, they can cause a lot of headaches. What's "knowen" about these systems, both their strengths and their weaknesses, helps us use them more effectively and with a little less stress. It's about being prepared for the quirks, and knowing what to do when things don't go exactly as planned, which is a pretty useful skill in our connected lives.

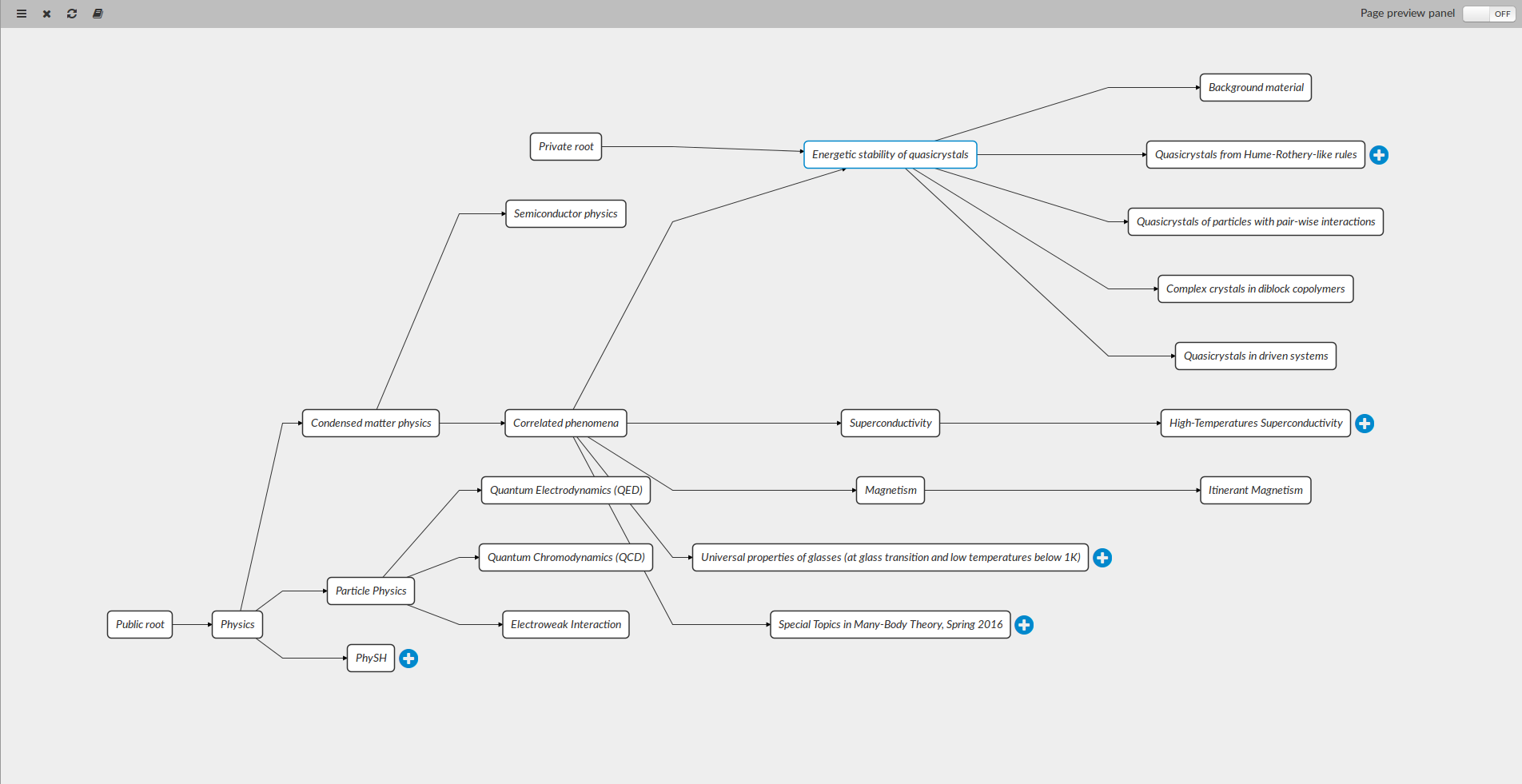

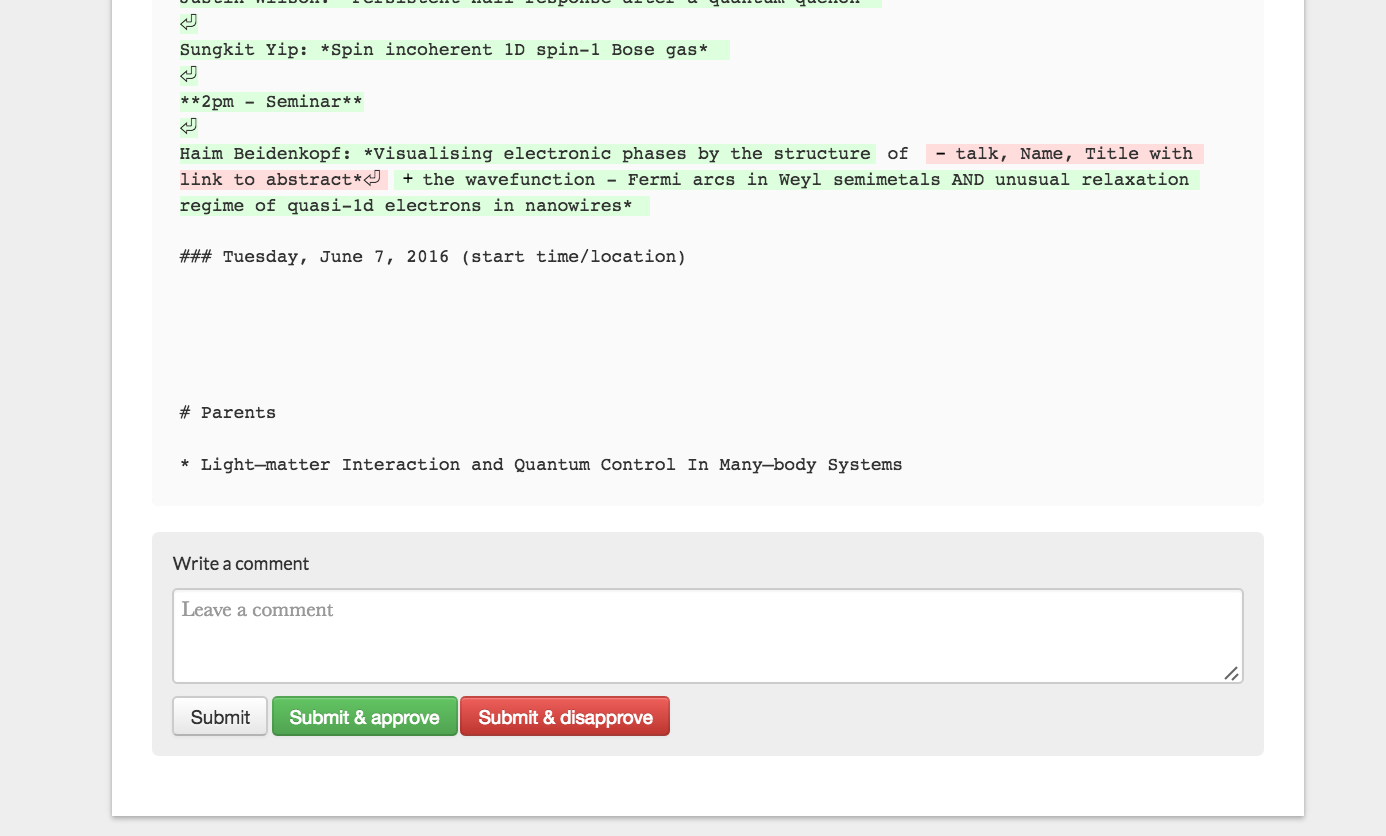

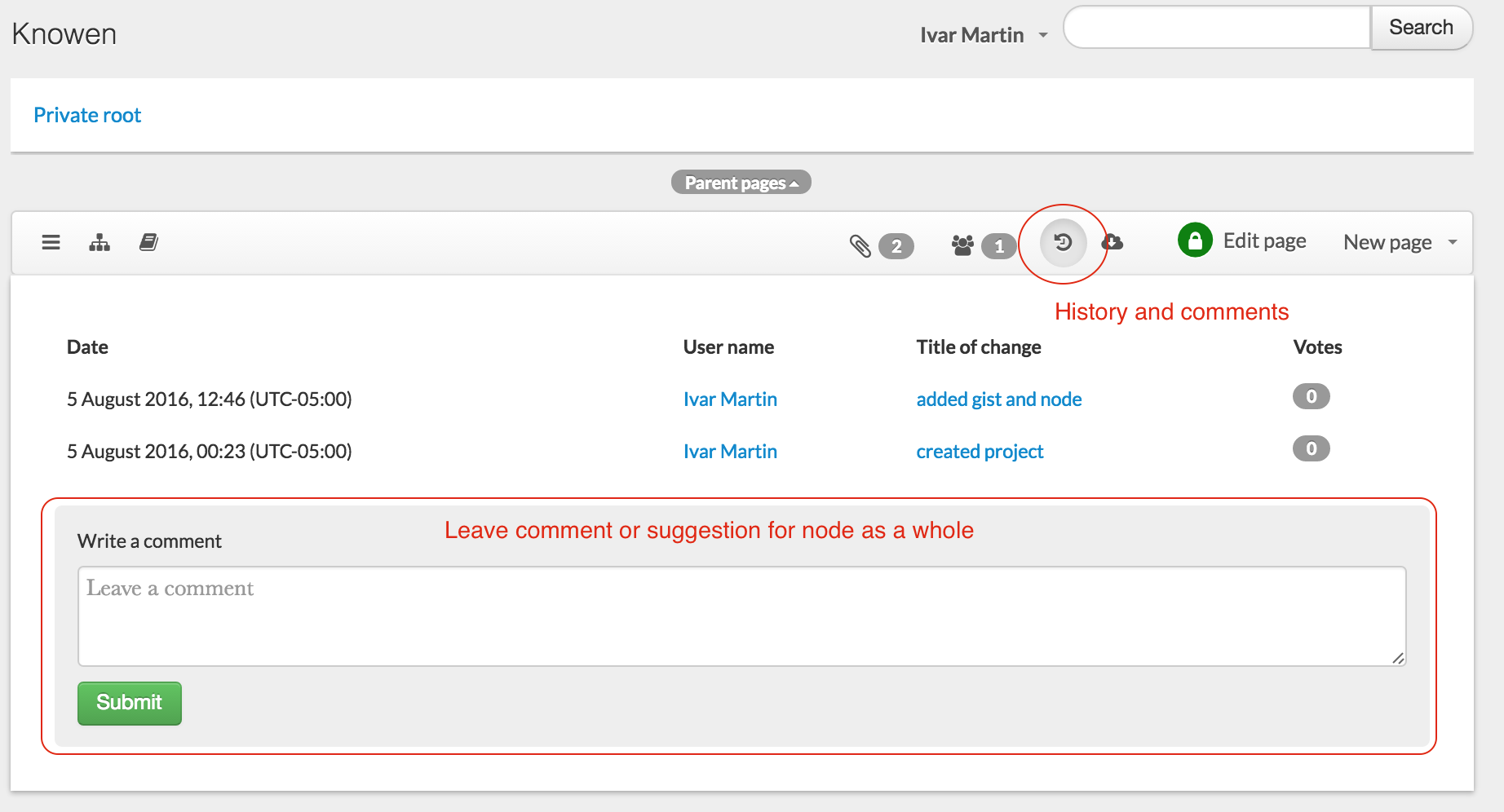

Knowen - accelerating discovery

Knowen - accelerating discovery

Knowen - Welcome to Knowen!'s attachments